Request To Waive Penalty - Sample Letter Of Request To Waive Penalty Charges - sample ... / For {number} years i have made monthly payments on this debt, without exception.

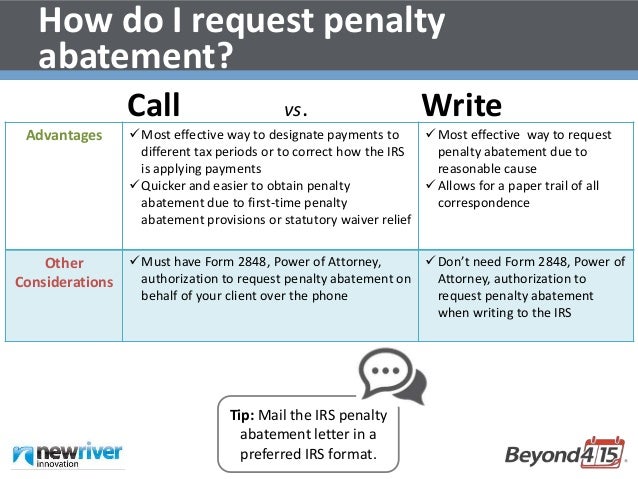

Request To Waive Penalty - Sample Letter Of Request To Waive Penalty Charges - sample ... / For {number} years i have made monthly payments on this debt, without exception.. An example of an irs request or sample letter for irs penalty abatement. Sdl and/or uif interest can't be waived. The irs grants four types of penalty relief, but many taxpayers don't ever ask. You need to tell us the reason for your late filing, non electronic filing or late payment. Alternatives to requesting waver of interest and penalties.

However, they may consider waiving penalties if you have been unemployed. You received a letter or notice in the mail from us with penalties and fees. Tax professionals who've handled a number of rmd penalty waiver requests say a request is most likely to be granted when the mistake was due to an error by a financial institution or the taxpayer had a serious illness or. A request can be sent for: (1) a defendant who waives service of a summons does not thereby waive any objection to the venue or to the jurisdiction of the court over the person of if a defendant fails to comply with a request for waiver made by a plaintiff, the court shall impose the costs subsequently incurred in effecting service.

You received a letter or notice in the mail from us with penalties and fees.

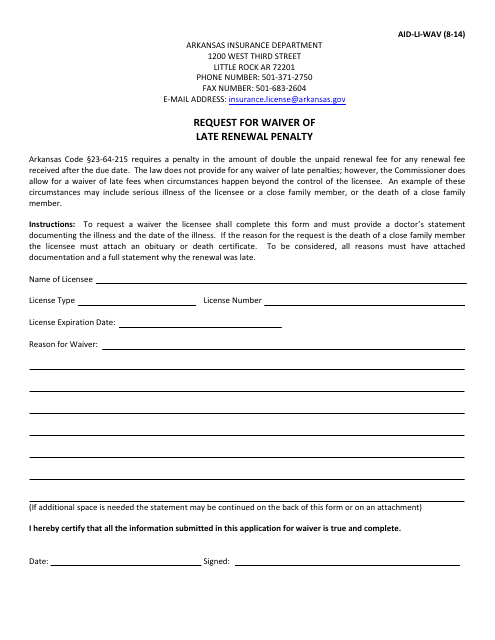

How to request a waiver of interest and penalties on insurance premium taxes, circumstances beyond control, disasters, civil disturbances, service disruptions, serious illness or accident, delay in process, interest, penalties. Visit letters for information about specific notices. You ask for the penalty to be waived by filing form 5329, completing part ix. A request can be sent for: If an unpaid balance remains on your account, interest will continue to. I recognize that a mistake was made by me and would rectify the problem. A penalty exemption will be granted if reasonable cause exists. If you have been charged a penalty but believe you have reasonable cause (e.g. Request for transcript of tax return. Section 11 of the skills development levies act and section 12 of the unemployment insurance fund act doesn't offer any. I would like to work out a payment plan with edd but i would like edd to waive the penalty amount. Sdl and/or uif interest can't be waived. State the reason you weren't able to pay, and provide copies—never the originals—of the documents you're offering as evidence.

The irs grants four types of penalty relief, but many taxpayers don't ever ask. You can use this template as a guide to help you write a letter. Penalty waiver request maximum waiver request not to exceed 6 monthly, 2 quarterly or 1 annual tax period(s) per taxpayer. You need to tell us the reason for your late filing, non electronic filing or late payment. Learn how to request penalty abatement from the irs.

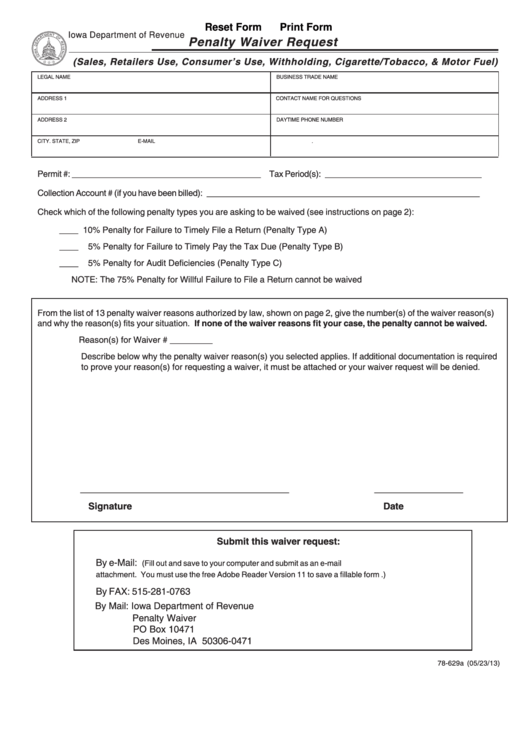

List the type(s) of tax for which this request applies along with the amount of penalty and the tax period(s) covered.

I am requesting that you waive the penalty fee and interest assessed on the above referenced account for the month of.,2013.the payment here was sent only one day late because of end of the year mailing issues.the payment was received only request for waiver of late subcharge of tax. Request for transcript of tax return. If you believe that a penalty should be waived because the failure to pay the tax on time was due to reasonable cause and was not intentional or due to neglect, you have the right to request a penalty waiver. The irs grants four types of penalty relief, but many taxpayers don't ever ask. Sdl and/or uif interest can't be waived. You mailed your report or payment on you may also send a letter to us at the address below explaining the situation and the reason you believe you should not be charged penalties and/or. You'll need to complete form 843, claim for refund and request for abatement, put 80% waiver of estimated tax penalty on line 7 of the form and mail the. Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause taxpayers who are unable to access the information electronically should submit the petition for waiver of penalty via email to penalty.waivers@tn.gov to request to waive a penalty. However, to claim the penalty relief, you had to submit irs form 2210 with your 2018 tax return or, if you already filed your 2018 return and paid the underpayment penalty, request a no, says the irs, which will automatically waive the penalty for these taxpayers. For {number} years i have made monthly payments on this debt, without exception. Apply to waive a penalty and let us know why you paid or filed your return late. Introduction the north carolina general statutes require the north carolina department of revenue to impose certain this document describes the penalty waiver policy of the department of revenue and supersedes all prior documents. Penalty waiver request maximum waiver request not to exceed 6 monthly, 2 quarterly or 1 annual tax period(s) per taxpayer.

If you believe that a penalty should be waived because the failure to pay the tax on time was due to reasonable cause and was not intentional or due to neglect, you have the right to request a penalty waiver. Reasonable cause may exist when you show that you used ordinary business care and prudence and. If an unpaid balance remains on your account, interest will continue to. (1) a defendant who waives service of a summons does not thereby waive any objection to the venue or to the jurisdiction of the court over the person of if a defendant fails to comply with a request for waiver made by a plaintiff, the court shall impose the costs subsequently incurred in effecting service. Learn how to request penalty abatement from the irs.

For {number} years i have made monthly payments on this debt, without exception.

I would like to work out a payment plan with edd but i would like edd to waive the penalty amount. Penalty waiver request, offer of compromise or protest. Income tax including corporate income tax (cit). Request for taxpayer identification number (tin) and certification. Penalty waiver request maximum waiver request not to exceed 6 monthly, 2 quarterly or 1 annual tax period(s) per taxpayer. I am writing to request that you waive the penalty of {amount} on account number {number}. It's true that i paid {number} days late, but there were extenuating circumstances. Enter amount of penalty requesting. For {number} years i have made monthly payments on this debt, without exception. Iowa department of revenue www.iowa.gov/tax reset form print form penalty waiver request (sales, retailers use, consumers use, withholding, cigarette/ tobacco, & motor fuel) legal name business. However, if you want to improve your chances of your request being accepted, you should work with. Learn how to request penalty abatement from the irs. You mailed your report or payment on you may also send a letter to us at the address below explaining the situation and the reason you believe you should not be charged penalties and/or.

Komentar

Posting Komentar